Carmakers split on which eco-friendly system is best

Carmakers split on which eco-friendly system is best

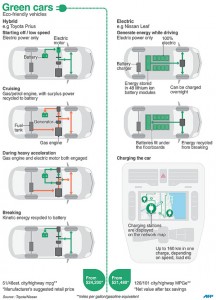

CARMAKERS are locked in a showdown as they bet on what eco-friendly vehicles will prevail in the battle for dominance of the burgeoning low-emissions sector.

Already have an active account? Log in here.

Continue reading with one of these options:

Continue reading with one of these options:

Premium + Digital Edition

Ad-free access

P 80 per month

(billed annually at P 960)

- Unlimited ad-free access to website articles

- Limited offer: Subscribe today and get digital edition access for free (accessible with up to 3 devices)

TRY FREE FOR 14 DAYS

See details

See details

If you have an active account, log in

here

.