But public spending lags despite 18% collection growth

But public spending lags despite 18% collection growth

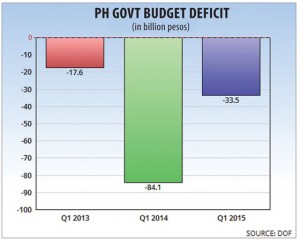

The budget deficit of the national government narrowed 60 percent in the first quarter of 2015 from a year earlier as the rise in public spending trailed the increase in revenue collection during the period, the latest official data shows.

Already have an active account? Log in here.

Continue reading with one of these options:

Continue reading with one of these options:

Premium + Digital Edition

Ad-free access

P 80 per month

(billed annually at P 960)

- Unlimited ad-free access to website articles

- Limited offer: Subscribe today and get digital edition access for free (accessible with up to 3 devices)

TRY FREE FOR 14 DAYS

See details

See details

If you have an active account, log in

here

.