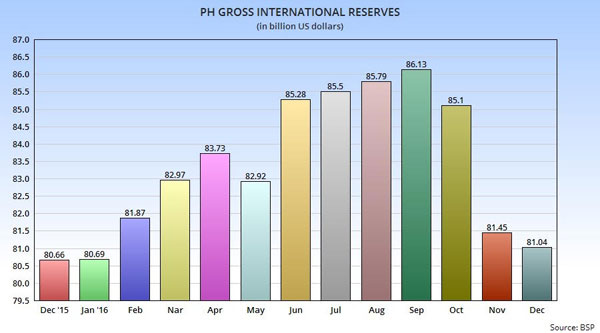

THE Philippines’ gross international reserves (GIR) dropped to their lowest level in 11 months in December and failed to hit the central bank’s forecast for the month, official data showed on Friday.

Already have an active account? Log in here.

Continue reading with one of these options:

Continue reading with one of these options:

Premium + Digital Edition

Ad-free access

P 80 per month

(billed annually at P 960)

- Unlimited ad-free access to website articles

- Limited offer: Subscribe today and get digital edition access for free (accessible with up to 3 devices)

TRY FREE FOR 14 DAYS

See details

See details

If you have an active account, log in

here

.